Boost Your Business Earnings with the most up to date 2D Payment Gateway Solutions

Boost Your Business Earnings with the most up to date 2D Payment Gateway Solutions

Blog Article

The Role of a Settlement Entrance in Streamlining Ecommerce Payments and Enhancing User Experience

The combination of a settlement gateway is crucial in the ecommerce landscape, offering as a safe and secure channel in between consumers and merchants. By making it possible for real-time purchase handling and sustaining a selection of settlement techniques, these gateways not just alleviate cart desertion yet also boost general consumer contentment.

Recognizing Settlement Entrances

A settlement entrance offers as a vital intermediary in the ecommerce transaction procedure, assisting in the secure transfer of repayment info in between clients and vendors. 2D Payment Gateway. It enables on-line organizations to accept numerous kinds of repayment, consisting of bank card, debit cards, and digital wallets, therefore broadening their client base. The portal runs by securing delicate info, such as card details, to guarantee that data is transmitted firmly over the internet, reducing the risk of scams and information violations

When a customer launches a purchase, the settlement gateway captures and forwards the deal information to the proper banks for authorization. This process is commonly seamless and takes place within secs, offering customers with a liquid purchasing experience. Settlement portals play a pivotal duty in conformity with sector requirements, such as PCI DSS (Repayment Card Market Data Security Standard), which mandates strict protection measures for refining card settlements.

Comprehending the mechanics of repayment portals is important for both consumers and vendors, as it straight influences purchase performance and client trust fund. By making sure effective and protected deals, settlement gateways add significantly to the general success of shopping organizations in today's electronic landscape.

Trick Attributes of Settlement Gateways

Numerous vital features specify the efficiency of settlement entrances in shopping, guaranteeing both protection and ease for users. One of the most vital functions is robust protection procedures, including file encryption and tokenization, which safeguard delicate consumer data during purchases. This is important in cultivating count on between sellers and consumers.

Moreover, real-time deal handling is important for making certain that repayments are completed promptly, minimizing cart desertion rates. Settlement gateways also provide fraud discovery devices, which keep track of transactions for suspicious task, further protecting both sellers and consumers.

Benefits for E-Commerce Companies

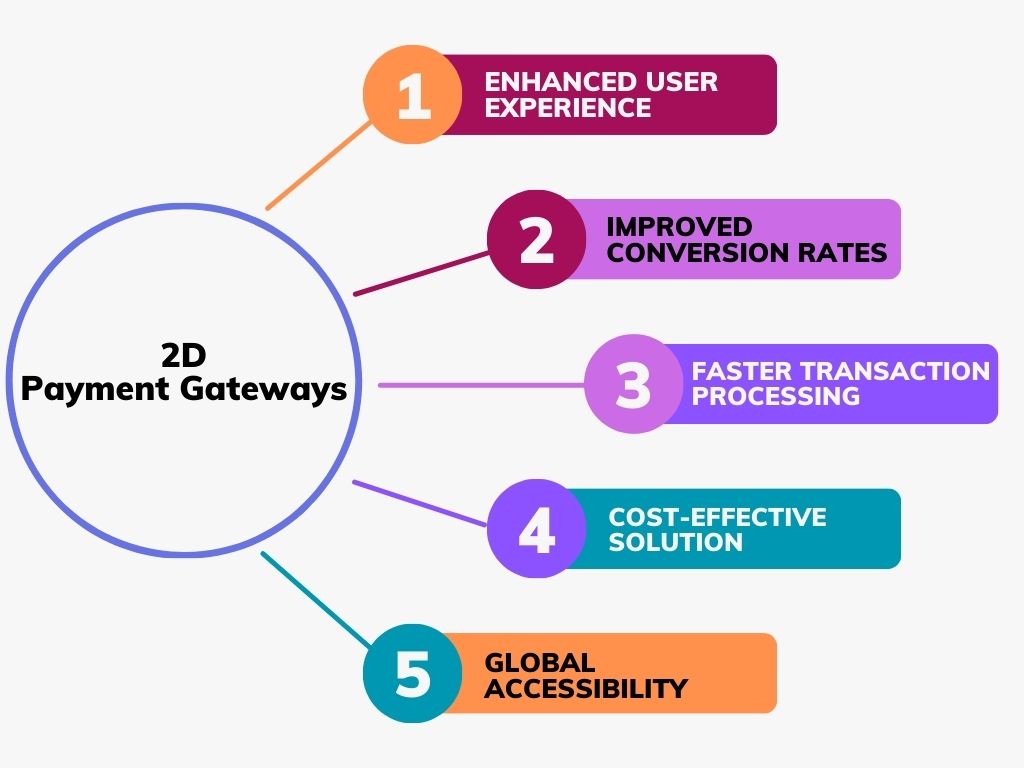

Various advantages occur from incorporating settlement gateways into ecommerce companies, substantially boosting functional effectiveness and consumer contentment. Most importantly, repayment gateways assist in smooth transactions by safely refining repayments in real-time. This capability decreases the possibility of cart desertion, as customers can quickly finish their acquisitions without unnecessary hold-ups.

Moreover, settlement entrances support multiple repayment methods, fitting a varied variety of consumer preferences. This versatility not only draws in a more comprehensive client base however likewise fosters loyalty amongst existing customers, as they really feel valued when supplied their recommended payment alternatives.

Furthermore, the integration of a payment entrance typically causes enhanced safety and security functions, such as encryption and fraud detection. These steps protect sensitive customer info, consequently developing depend on and review integrity for the e-commerce brand name.

Moreover, automating payment procedures through gateways reduces hands-on workload for staff, permitting them to concentrate on critical initiatives as opposed to routine tasks. This operational effectiveness translates into price savings and improved resource allotment.

Enhancing User Experience

Integrating a reliable repayment gateway is essential for enhancing user experience in e-commerce. A reliable and seamless repayment process not just develops customer trust fund but additionally lessens cart desertion rates. By offering numerous payment choices, such as charge card, electronic budgets, and financial institution transfers, services accommodate diverse consumer choices, thus improving contentment.

In addition, an user-friendly interface is vital. Repayment gateways that supply intuitive navigation and clear directions allow clients to complete purchases promptly and effortlessly. This convenience of use is important, specifically for mobile customers, who need enhanced experiences tailored to smaller screens.

Safety functions play a considerable duty in customer experience as well. Advanced encryption and fraud discovery mechanisms guarantee clients that their delicate data is shielded, fostering confidence in the deal procedure. In addition, clear communication visit homepage relating to policies and charges boosts credibility and decreases possible frustrations.

Future Trends in Settlement Handling

As shopping remains to advance, so do the innovations and fads shaping repayment processing (2D Payment Gateway). The future of repayment processing is marked by several transformative patterns that promise to boost performance and individual complete satisfaction. One considerable pattern is the rise of man-made knowledge (AI) and artificial intelligence, which are being increasingly integrated into payment entrances to reinforce safety via innovative scams discovery and risk evaluation

Furthermore, the adoption of cryptocurrencies is getting grip, with more organizations discovering blockchain innovation as a feasible alternative to conventional repayment approaches. This shift not only supplies lower deal charges yet likewise attract a growing demographic that values decentralization and privacy.

Mobile pocketbooks and contactless payments are ending up being mainstream, driven by the need for faster, easier purchase methods. This pattern is additional fueled by the enhancing occurrence of NFC-enabled tools, making it possible for smooth purchases with just a faucet.

Last but not least, the focus on regulatory compliance and data security will certainly form repayment handling strategies, as services make every effort to develop count on with customers while adhering to advancing legal frameworks. These trends jointly suggest a future where repayment handling is not just faster and much more safe and secure yet likewise much more straightened with customer assumptions.

Conclusion

In final thought, payment entrances act as essential parts in the e-commerce ecological community, assisting in effective and safe and secure deal processing. By providing varied payment choices and focusing on individual experience, these entrances significantly minimize cart abandonment and enhance client fulfillment. The continuous evolution of payment technologies and security measures will better reinforce their duty, making sure that ecommerce businesses can meet the needs of increasingly innovative consumers while fostering depend on and trustworthiness in on the internet purchases.

By making it possible for real-time deal processing and supporting a selection of settlement approaches, these entrances not only mitigate cart desertion however likewise improve total client fulfillment.A settlement gateway go to my site offers as an essential intermediary in the shopping purchase procedure, assisting in the secure transfer of repayment details between clients and sellers. Repayment gateways play a critical duty in conformity with market standards, such as PCI DSS (Settlement Card Market Data Safety And Security Criterion), which mandates strict safety and security procedures for processing card repayments.

A versatile payment portal fits credit score and debit cards, electronic pocketbooks, and alternative repayment techniques, providing to diverse customer choices - 2D Payment Gateway. Settlement gateways assist in seamless deals by safely refining payments in real-time

Report this page